You need to manually enter the opening balance transactions in Quicken after the data is imported.

QIF file, leading to incorrect account balances. Opening balance transactions are sometimes not exported from Moneydance into the.For example, future-dated transactions or very old transactions. Discrepancies in Ending Balance could be caused by missing transactions if you choose to export a range that excludes transactions you have entered in Banktivity. After import Quicken will indicate if the ending balance in Quicken does not match reported Ending Balance in the import Log file (See Help > Show Logs in Finder to view your import log file). Banktivity exports the expected "Ending Balance" for each account in the. You need to manually add a ticker and import the price history for these securities. Securities without a ticker symbol are shown with a zero value in your portfolio.For this, you need to manually import this data into Quicken through a CSV file.

If you notice that there is a discrepancy in your balances or holdings even after resolving the above two issues, check your bond transactions for accuracy.

Some bond transactions may not be imported accurately.(Alternatively, you can manually enter these transactions in Quicken after import.) Or, in Banktivity, you can change these transactions to deposits and categorize the transaction as interest income. To resolve this issue, we recommend that you associate your interest income with a security in Banktivity, prior to exporting the data into the. Interest income transactions without a security are not exported into the.The import log file will also indicate the names of investing accounts that contain Stock Split transactions (See Help > Show Logs in Finder to view your import log file). For easy identification, Quicken flags stock splits with a blue icon in the status column.

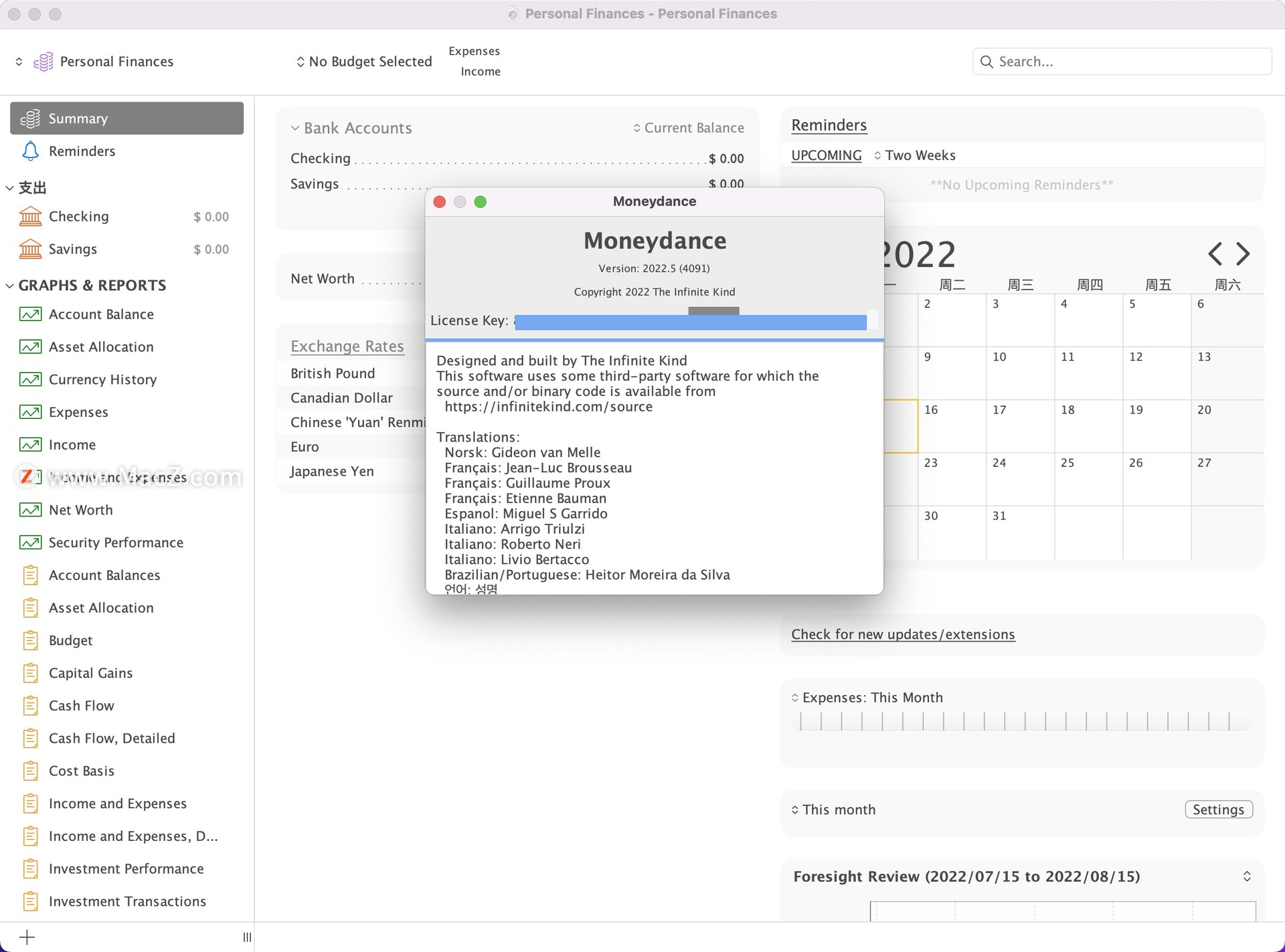

#MONEYDANCE FOR MAC UPDATE#

As such, if your data contains reverse stock splits, you need to manually update them after import. Banktivity exports these transactions without flagging them as positive splits (for example, 2 for 1) or reverse splits (for example, 1 for 2). Banktivity (formerly iBank) import issues

#MONEYDANCE FOR MAC FOR MAC#

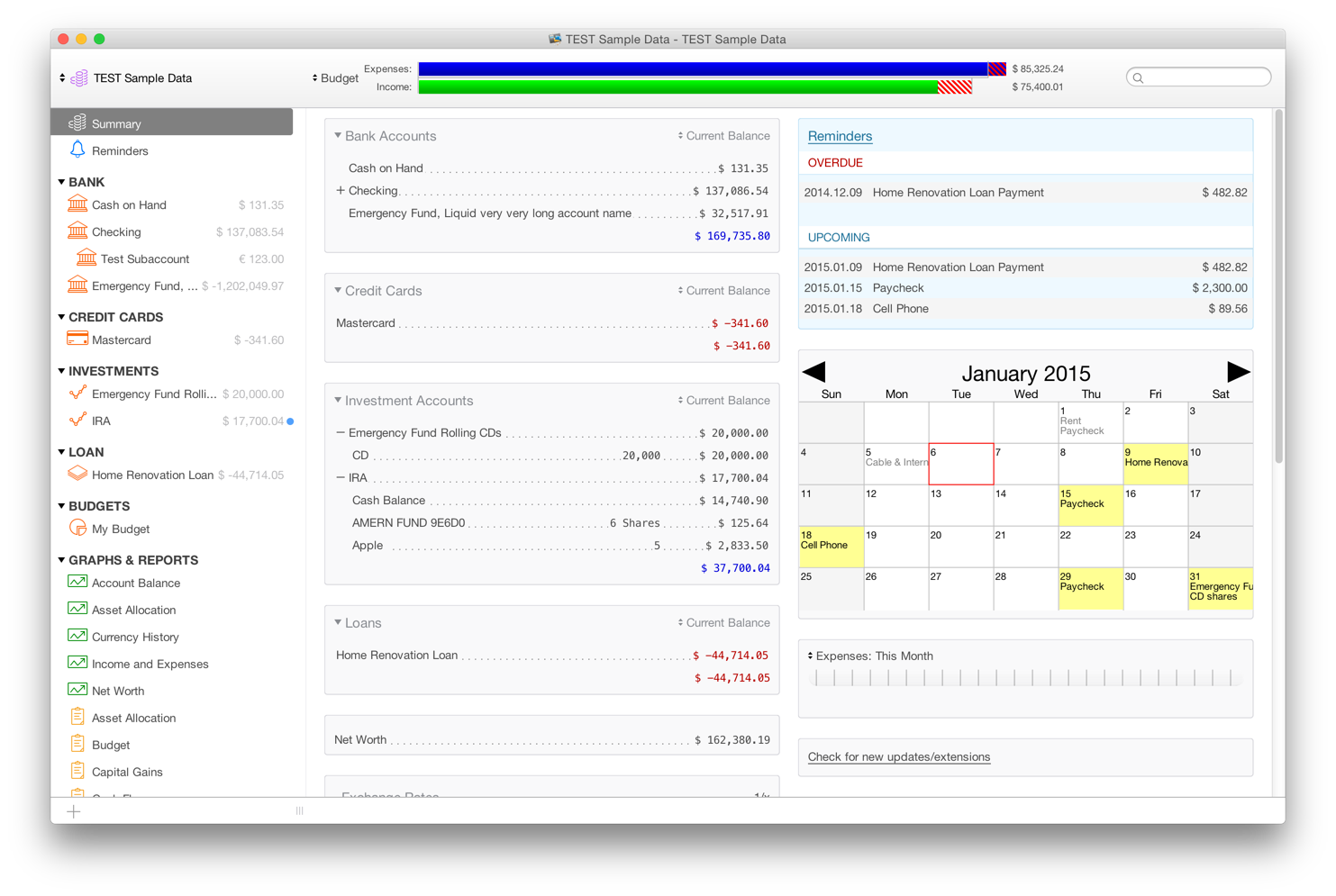

That said, don't expect to use this app on your smartphone or tablet.Įditors' note: This is a review of the trial version of Moneydance for Mac 2014.This topic explains some actions you may need to take after you follow the steps in this article to import data from Banktivity or Moneydance into Quicken for Mac. It's a full-fledged personal finance manager with a slick interface, and while it does come with a price tag, its power and flexibility definitely make up for it. If you need to track your expenses on your Mac, look no further than Moneydance for Mac. While an iOS app is available, it is nowhere near as polished and powerful as the Mac version. The program's only major downside is the lack of decent mobile support. In terms of performance, you will be impressed with Moneydance's speed and relatively low demand for system resources considering its data processing features: it consumes only around 250MB of RAM. The app comes prepopulated with the most popular currencies, types of accounts, and expenses, but you can choose which types of prepopulated entries to show as well as create custom ones. Entry creation, which in the trial version is limited to 100 entries, is easy, though a bit overwhelming at first. To enjoy all its features, however, you will have to buy the premium version.įollowing a straightforward installation, Moneydance for Mac gives you the option to import previous databases or start from scratch. It covers everything you could want from a financial application - multiple account support, multiple currencies, printing, filtering, and more - all placed in a beautiful, well-designed interface.

#MONEYDANCE FOR MAC PROFESSIONAL#

With its depth, plethora of options, and convenient report styles, Moneydance for Mac stands out as a professional financial software.

0 kommentar(er)

0 kommentar(er)